Don't go without downloading our free retirement guide!

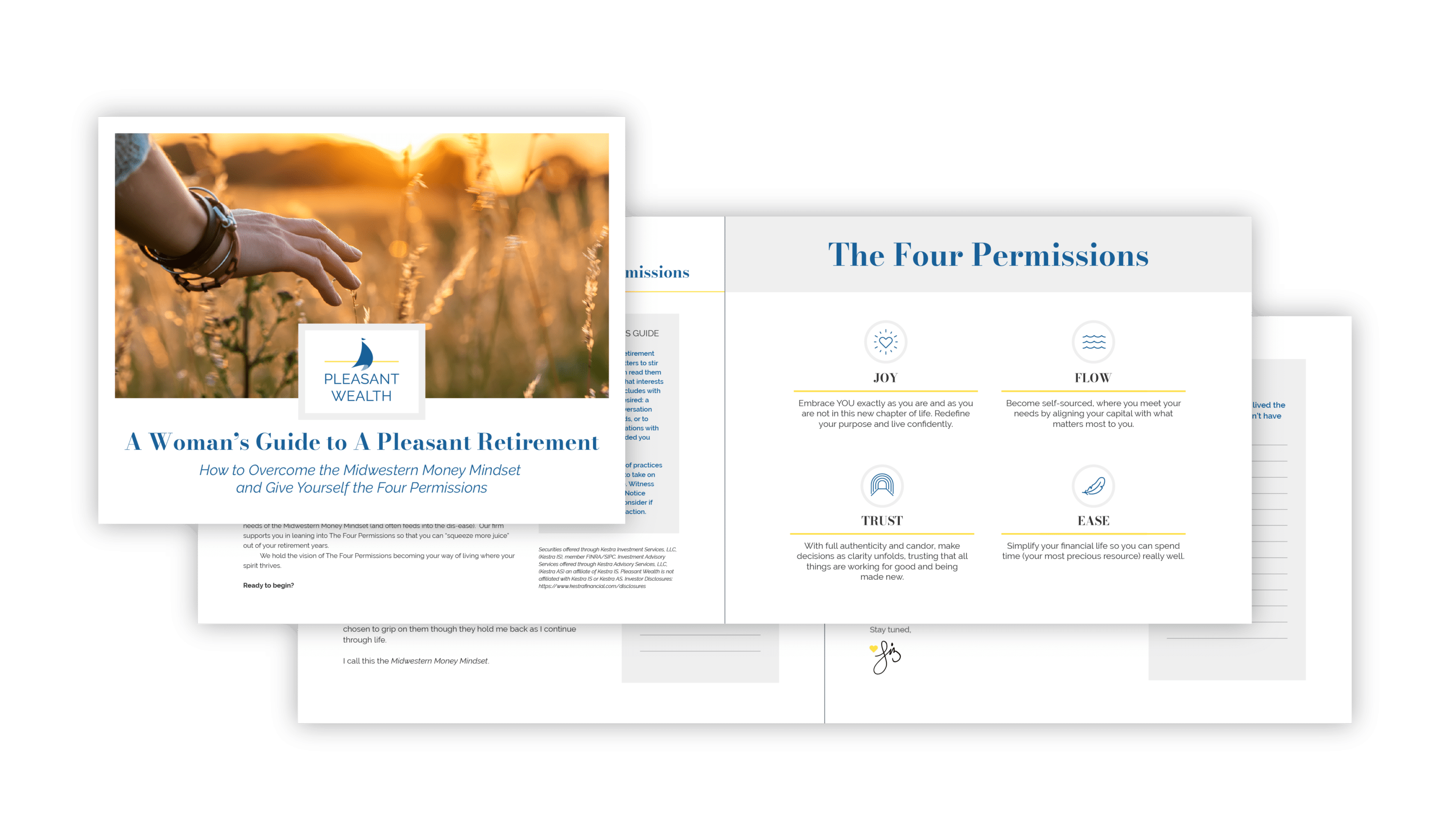

A Woman’s Guide to a Pleasant Retirement

How to Overcome the Midwestern Money Mindset and Give Yourself the Four Permissions

Check the background of this firm on FINRA’s BrokerCheck →

A famous physics professor, (maybe Einstein, maybe another according to Quora) said “The greatest shortcoming of the human race is our inability to understand the exponential function.”

In an exponential curve the number being compounded accelerates and leaps ahead dramatically.

Regarding investing, it does so for the good (money grows). Regarding a pandemic, it does so for the bad (sickness grows).

Our financial industry is used to exponential curves – clients should benefit from a good exponential curve of investments.

Epidemiologists were afraid the bad curve of this pandemic would overwhelm our hospitals. However, we complied at a nearly 90% rate when the models had assumed only a 50% compliance rate.

This is very good news. We flattened the curve. Tens of thousands of real persons have stayed healthy and are still with us. This is a roaring success.

Therefore, I find myself dismayed when I hear about financial professionals conspiratorially complaining about the economic sacrifices needed to keep these people safe.

They complain that the governments’ models are wrong. That hospitals won’t be overwhelmed. They do not see how we have sidestepped a bad exponential curve. Rather they see some anti-freedom conspiracy, not present.

The economy of the United States is a little north of $20 trillion per year. For about one calendar quarter the economy is being taken down almost 40%.

Then, the Treasury Department and the Federal Reserve created new money to fill that 40% gap.

You could almost see it as a “medically induced coma”. They showered the money in an attempt to “keep the patient alive” until the pandemic is under control. This is a possibility only because we flattened the curve.

We will “revive the patient” in phases. I am optimistic that, just as we worked together to flatten the curve, we will work together to revive the economy.

The pandemic is accelerating some existing trends and creating new opportunities and pitfalls. As a result, our carefully curated managers are licking their chops and starting to invest in the new winners that are now emerging.

Although we have no real idea on the best time to invest, I encourage clients to look ahead positively.

We can control only our attitude. And our attitude should be one of great hope. We are not called to fear.

-Ellis