Don’t go without downloading our free retirement guide!

A Woman’s Guide to a Pleasant Retirement

How to Overcome the Midwestern Money Mindset and Give Yourself the Four Permissions

Check the background of this firm on FINRA’s BrokerCheck →

Your paychecks are your livelihood. They connect you to the people, places, tastes, sounds, and joy that life has to offer. That’s why we prioritize “paycheck” conversations in your retirement income plan.

When you’ve considered retirement, your mind gets stuck in fear of where (or if) paychecks will come. Many people worry they will have to cut expenses and change their livelihood just to retire. What if instead of over-budgeting, you were able to experience the relief of a process that helped you maximize your retirement income in a consistent, reliable way?

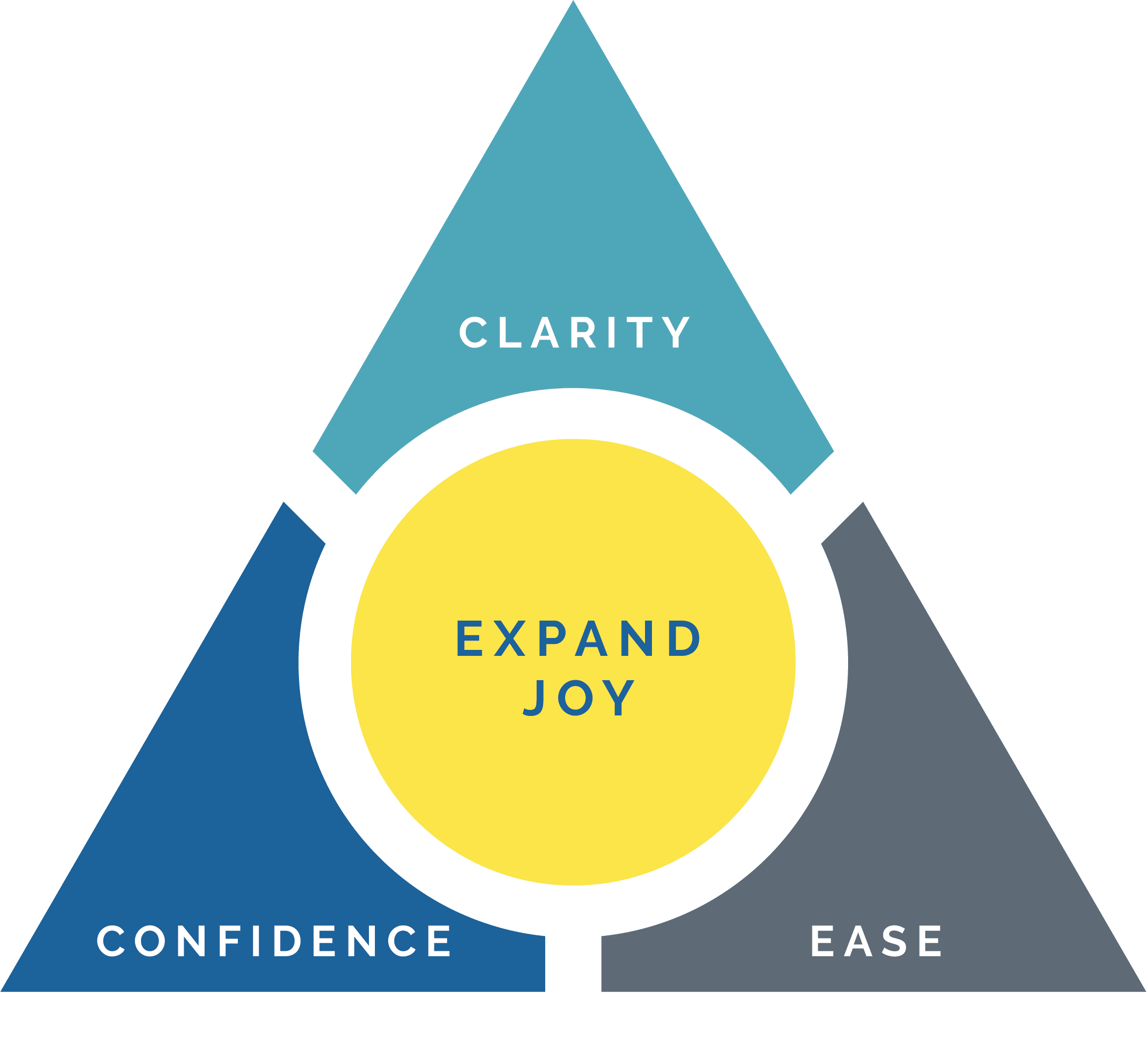

When you have the complexity of many resources with different taxation rules like social security, pensions, IRAs, 401ks, brokerage accounts, capital gains, income tax, tax-deferred, or tax-free – there is a feeling of “not knowing what you don’t know”. We partner with you to create a financial strategy that optimizes your income over your whole life span. Our guardrails process will give you the confidence to know you’re ready to retire.

“61% of Americans believe their parents are a vital influence in managing their finances more than they turn to their spouse/partner, internet websites and blogs, financial advisors, or school classes. However, money is not readily discussed in homes. Only 9% of parents had discussed managing student loans with their children, and only 13% talked about planning for retirement.”

PR Newswire

Many women feel burdened by the complexities of all the moving parts of retirement and not knowing where to start. As your financial thinking partner we have the brains to handle the complexity and the heart to help you align your money with your life.

Independent women 50+ nearing retirement

Women redefining life and money after loss

Friendly, open-minded couples

Those who can sustainably meet our minimum annual planning fee of $5,000

Those who value a long-term partnership with an advisor firm

When you quit your job, you have three main options with it, or a combination of all. You can leave it where it is, you can cash it out, or you can roll it over to an IRA or Roth IRA. Each have different tax, fee, and advisor considerations.

Often when a person is retiring, rolling over the 401k to an IRA or Roth IRA and working with a personal advisor gives them the personal advice & income options they need.

Any advisor can work with you in the accumulation process. When you retire, look for an fiduciary advisor that has expertise in the decumulation process. They should be well acquainted with taxes in retirement, required minimum distribution rules, and have a process for creating income without always defaulting to an annuity.

A good retirement income meets your monthly expenses, with a few trims to your lifestyle. A better retirement income matches your monthly expenses and lifestyle without changing them. A great retirement income provides for your monthly lifestyle expenses and extra for new adventures or endeavors. The amount varies from person to person. In the midwest we see monthly expenses range from $2,000/month to $12,000/month or more.

Consider a better question to ask yourself: what are you already spending monthly? When you answer this question confidently, we can better help you with retirement income. Check out this video for more information: https://youtu.be/K9XMv0XAbZc

The main purpose of tax planning is to keep more of your money for yourself rather than unnecessarily sending it to Uncle Sam. CPAs do this for you with your current tax year. Financial Planners look at current market trends and any advantages you can get within your portfolios. They also look at long-term tax trends based on the projected income you will be taking in retirement.

When you are requesting an action or we are bringing a suggestion that has a conflict of interest, we will be the first to bring it up, as Candor is one of our company values.

You’re near the right place with asking this question. A better question to ask yourself is what are you already spending monthly without changing anything? When you answer this question confidently, a good retirement income advisor can help you see what’s possible for income with your retirement resources. Check out this video for more information: https://youtu.be/K9XMv0XAbZc