Don’t go without downloading our free retirement guide!

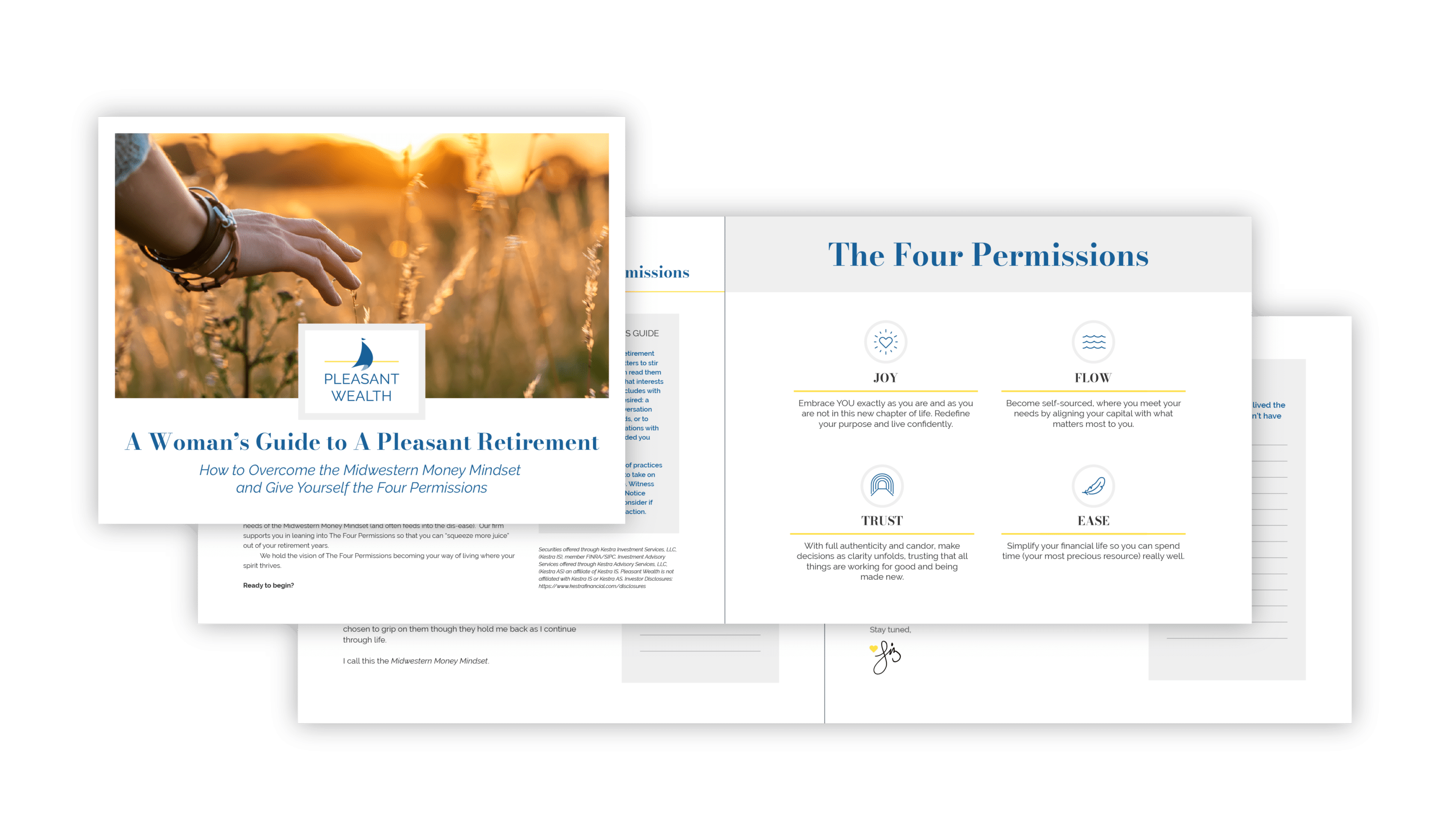

A Woman’s Guide to a Pleasant Retirement

How to Overcome the Midwestern Money Mindset and Give Yourself the Four Permissions

Check the background of this firm on FINRA’s BrokerCheck →

Are you planning to retire on a pension? If you or your spouse live in Ohio and contributed to OPERS, STRS, or SERS, you probably intend it to be a foundational part of your retirement income. But too often, workers contribute to their pensions and other savings without giving much thought to the benefits until it’s time to claim.

It’s worth taking time to learn how your pension works, how it fits into your bigger income plan, and potential surprises that affect your income. Here are the basics you should know about your pension

OPERS is a state pension designed to provide financial security to public sector employees in Ohio, firefighters, police officers, and other government workers after they retire. STRS is the pension plan for teachers in Ohio. SERS is a pension for non-teaching school employees. These plans are critical benefits that help recruit and retain skilled professionals in public service at all income levels.

Typically, a worker in a job covered by an Ohio pension doesn’t contribute to Social Security, and they won’t qualify for Social Security benefits. For this reason, pensions can be a primary source of retirement income.

Workers fund their pensions over their careers by making regular contributions from their paychecks, like a 401(k). Unlike 401(k)’s, pensions are defined benefit plans, where benefits are pre-determined, and the state takes on the risk of funding the benefits.

Pension plans are primarily established to provide retirement income. But disability & healthcare benefits are provided by Ohio pensions as well.

All Ohio pension benefits are typically based on years of service, salary, your age at retirement, and the payout option you select.

For example, here’s how OPERS benefits are calculated, based on Final Average Salary. FAS is the average of the highest 3 or 5 years of salary:

Retirement benefit = (2.2% of FAS) X (Years of Service) + (2.5% of FAS)

STRS and SERS use slightly different calculations. However, in all cases, a higher salary and longer service will increase your benefits. You’ll receive full unreduced benefits at your full retirement age, and reduced benefits if you claim them early.

The best way to know your benefits is to call the phone number on your pension statement. A representative can outline your options.

If you worked another job covered by Social Security, you may be entitled to retirement benefits. It’s important to note your OPERS, STRS, and SERS benefits may reduce the Social Security benefits you or your spouse receive. This reduction is sometimes called an offset. If you’re in this situation, double-check your benefits so you don’t have any income surprises after you retire.

Pensions provide a great base for retirement income, but the amounts are fixed. Any cost of living increases are out of your control. For that reason, many state workers set aside additional savings. They may also have retirement plans from other jobs. STRS has introduced a defined contribution plan alongside the more traditional defined benefit pension plan. It’s very common for a state retiree to have multiple accounts and pensions, and they need to carefully plan their income.

If you’re a single person whose sole source of retirement income is a pension, planning out your income is straightforward. But for most people, the situation is more complicated.

We often work with married couples who need to plan income from Social Security, OPERS, STRS, SERS, an old 401(k), Roth IRA accounts, & perhaps some part-time work. Each is taxed differently, and each has different rules. Furthermore, married couples need to time their benefits carefully. Timing can make a huge difference if one spouse passes away unexpectedly.

Many of our clients successfully navigated their complicated benefits statements and now receive a simple, reliable income stream they understand. If you have questions about how your benefits fit into your retirement picture, schedule a no-cost consultation call here. We’re here to support you and we want you to feel good about your money.

Clinton Miller, CFP®, is an investment advisor & financial planner with an educational background in mathematics. He enjoys making tax planning relevant for clients so they can make confident money decisions.

He and his wife Aubrey are based in Canton, OH & have two sons. In his spare time, he enjoys fishing, chainsaw repair, & mucking around in the woods.