Don’t go without downloading our free retirement guide!

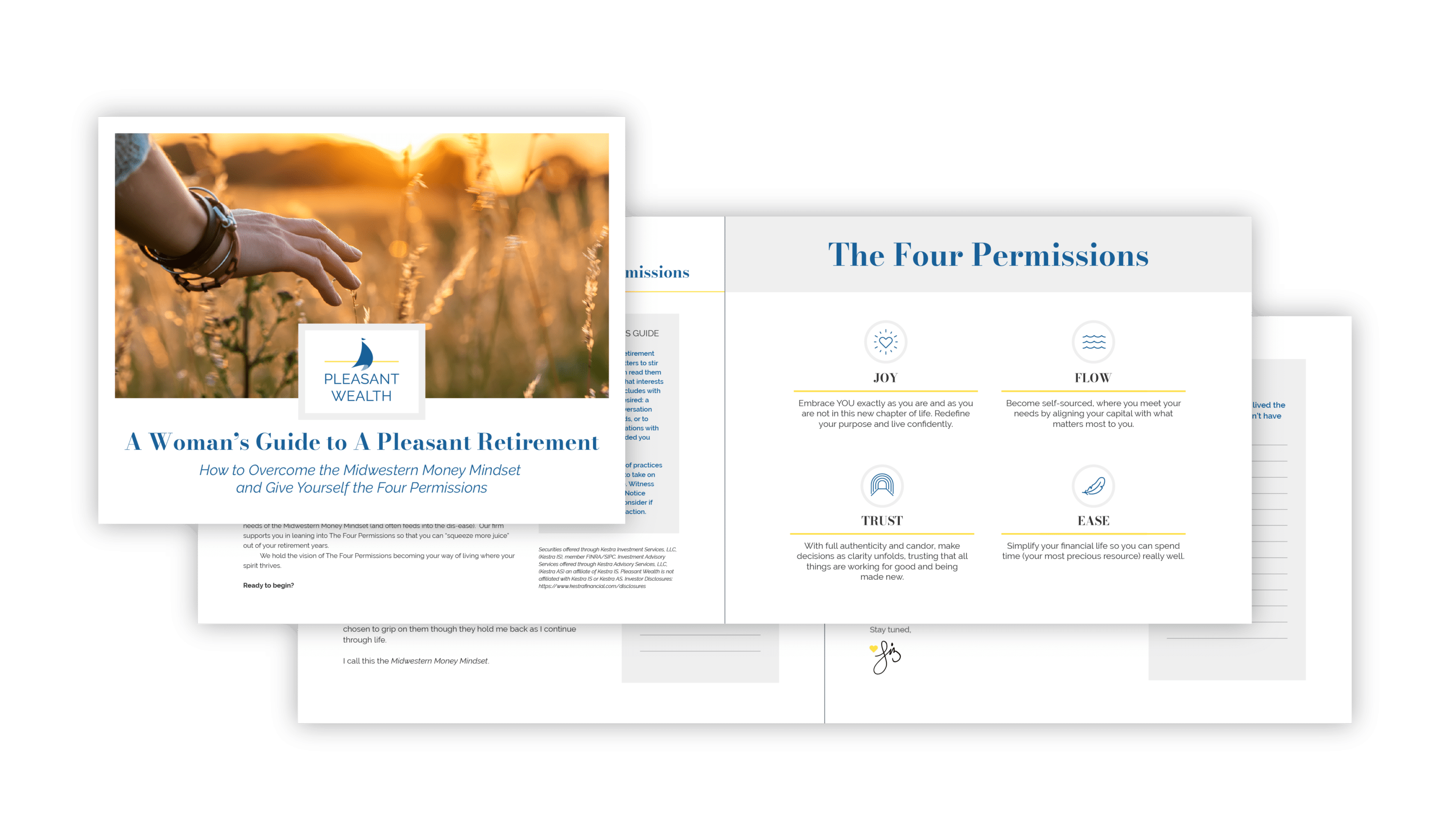

A Woman’s Guide to a Pleasant Retirement

How to Overcome the Midwestern Money Mindset and Give Yourself the Four Permissions

Check the background of this firm on FINRA’s BrokerCheck →

I love tax season; it really is the best time of year.

Don’t get me wrong, it’s not that I like paying taxes. But there’s just so much good stuff happening right now. Warblers are migrating north, Trout are biting after a long winter, and Turkeys are gobbling and drumming in the woods. And—we’re helping our clients proactively manage taxes for the years ahead.

Could it get any better? Well, maybe. It depends if I can fish this weekend. I’ll report back.

But seriously, we love tax planning. Here are four real scenarios where Pleasant Wealth clients saved a ton of money in tax costs:

A client eliminated six figures in taxes by creating a Donor Advised Fund for his charitable goals. Donor advised funds allow you to pre-fund years of charitable giving in a single year, maximizing tax control while income is very high. They’re useful for people with a year of unusually high income who are long-term charitably inclined.

A couple will save $75k in taxes during retirement by carefully following Net Unrealized Appreciation rules when rolling money out of a 401(k). By carefully following NUA tax rules, income that would otherwise have been taxed as income (22%) will be taxed as long-term capital gains (0% in this case).

If you own company stock when you retire, you need to consider the many tax implications of your exit and sale. We help clients make smart exit plans.

In 2023, clients turned investment lemons into tax lemonade with Roth conversions. 2022 was a terrible year for investments. The S&P 500, one of the most notable stock indices, lost nearly 20% during 2022. That gave investors the opportunity to shift shares from IRAs to Roth IRAs with less tax friction. By completing these timely conversions, our clients have bigger pools of tax-free money available for income, surviving widows, and their heirs.

Dozens of clients sent thousands of dollars to charity instead of to the IRS. If you have an IRA, support charitable organizations, and you’re 70 ½ or older, you can send money directly from your IRA to the charity in a tax-free transaction.

It’s important to let your tax preparer know you’re making a QCD so you don’t miss the deduction, which is why we coordinate directly with our customers’ tax pros on their behalf.

Now is a great time to review your long-term tax plan. If you have questions about your tax 2023 return, contact your Pleasant Wealth advisor or email clients@pleasantwealth.com.

This piece is an excerpt from April’s version of the Pleasant Post, our monthly newsletter. Interested in reading more about topics like this? Subscribe here.

Clinton Miller, CFP®, is an investment advisor & financial planner with an educational background in mathematics. He enjoys making tax planning relevant for clients so they can make confident money decisions.

He and his wife Aubrey are based in Canton, OH & have two sons. In his spare time, he enjoys fishing, chainsaw repair, & mucking around in the woods.