Don’t go without downloading our free retirement guide!

A Woman’s Guide to a Pleasant Retirement

How to Overcome the Midwestern Money Mindset and Give Yourself the Four Permissions

Check the background of this firm on FINRA’s BrokerCheck →

As we near Tax Day for 2025, it’s the time of year when some folks are getting what they may consider a “bonus payday”: a refund from the IRS. Whether it’s a tax refund, a work bonus, or a pay raise, these moments involving an influx of additional money can prompt a pernicious predicament. Should you spend the money? Stockpile it away? Pay off the rest of your car loan?

The answer to this question isn’t always straightforward (isn’t that often the case?) Sure, you may feel a pull in a certain direction, an inclination of what’s best. But it can be hard to know what is truly the best financial choice.

The reason why it can be difficult to discern a “best” choice is the mix of factors at play. You have to consider your proximity to retirement—or if you’re already retired — current financial situation, risk tolerance, and long-term goals, to name a few. This decision doesn’t boil down to answering only one question.

So let’s explore the key factors for making a decision between clearing out debt, investing more, or a combination of the two for women nearing or in retirement. My goal? To help you make an informed decision that aligns with your retirement goals and financial (and emotional!) well-being.

Before choosing a path at the fork in the road of investing or paying down debt, it’s important to first focus on this question through the lens of your financial position.

For women nearing or in retirement, this can certainly feel like a pivotal financial moment in your life, as if each financial decision carries a great deal of weight. While there are many different aspects to your financial picture, let’s simplify it to four main areas to reduce the overwhelm as much as we can:

For many women, entering retirement debt-free can offer a sense of security and peace of mind. Here are three possible reasons why paying down debt might be the best approach.

Eliminating debt means fewer monthly obligations, which can potentially make your budget more predictable and reduce financial anxiety. Let’s say you didn’t have a $300 car payment each month. How would that make you feel?

With fewer debt payments, or none at all, you’ll have more flexibility in your budget for other expenses, including healthcare and leisure.

There’s a reason the debt-to-income ratio is used as part of the home-buying process. Lending agents need to know how a mortgage will realistically fit into your finances so you don’t default on the loan. It’s the same with your budget in the broad sense. The lower your debt-to-income ratio—that is, the less of the income pie your debt takes up—the more room you have to afford other things or withstand unexpected expenses.

If you have credit card debt or high-interest loans, paying them off can save you thousands in interest. There are plenty of financial calculators out there on the internet, including this one, that can effectively illustrate the impact of paying off a loan early.

Take a $400,000 mortgage loan at 6.7%, the average rate for a 30-year fixed mortgage in 2024, according to this article. If you paid an additional $100 a month over the life of the loan, you’d save $67,395 in interest. That’s a lot of money.

Conversely, investing your money might be the smarter move—or just a more palatable one for you personally—if your debt is manageable, you have a higher risk tolerance, or you have a longer time horizon before retiring, among other reasons.

Investing allows your money to grow over time, potentially outpacing the cost of low-interest debt.

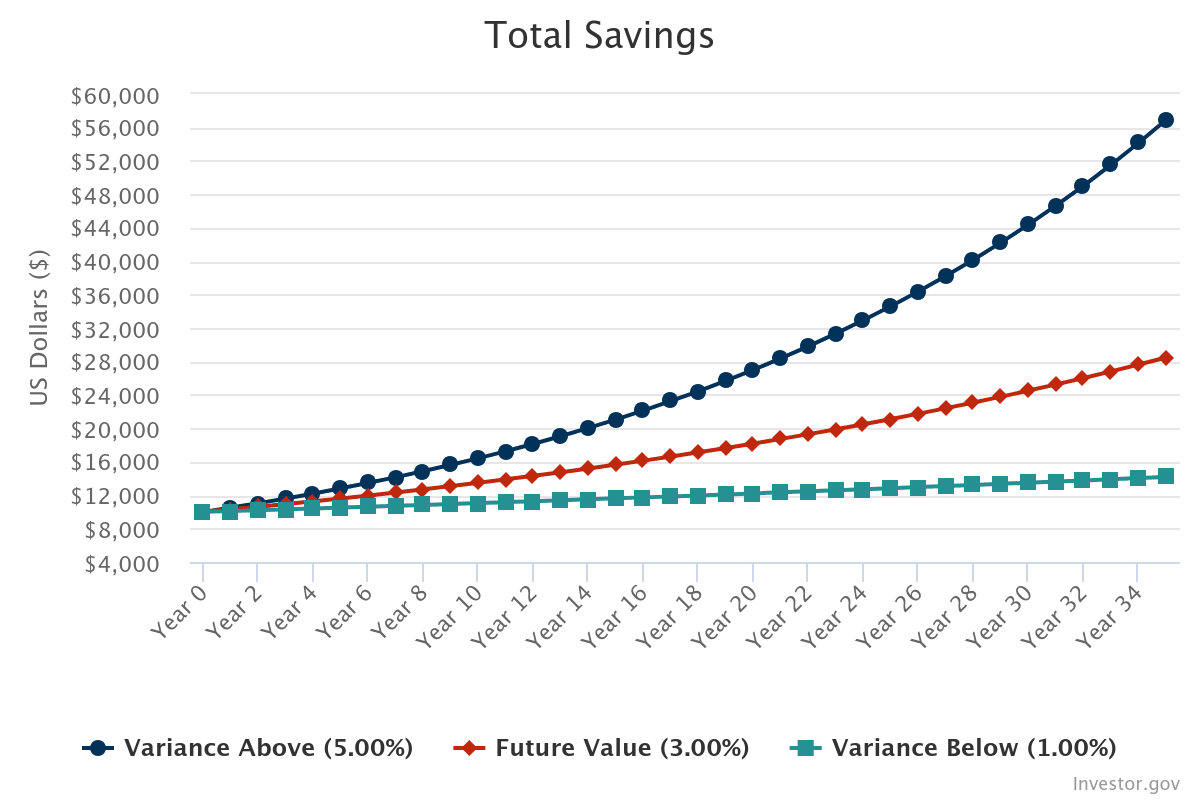

Speaking of financial calculators that can show you effective examples, here’s a compound interest rate calculator from investor.gov. While we saw a big difference in our mortgage payoff example earlier, let’s consider a compound interest growth example. If you put $10,000 into an investment account at age 30 and simply let the interest compound annually at an average rate of 3%, you’d have more than $18,000 in compound interest alone by the time you hit retirement.

And as the chart below shows, if the interest rate was just 2% better, you would more than double the compound interest by retirement age, with more than $45,000 in interest earnings.

Now, this is a simple example that doesn’t involve any ongoing contributions, but it still shows the value of compounding growth.

Keeping funds in investments rather than aggressively paying off debt ensures you have access to money in case of an emergency.

Even if you have an emergency fund, there is something to be said about the peace of mind of knowing you have access to money if you need it. Plus, there are investments like money market funds and some shorter-term Certificates of Deposit (CDs) where you can readily access money on shorter notice.

If you’re still working, contributing to a 401(k) with an employer match or funding tax-advantaged accounts like IRAs can be a valuable opportunity. In those cases, the additional funding to your retirement account or the tax benefits of contributing to an IRA may outweigh the benefits of paying off debts.

For many women in or near retirement, the best solution isn’t an all-or-nothing approach—it’s a balance of both. Here are four tips to help you create a strategy that works for you:

There’s no one-size-fits-all answer to this debt vs. investing debate. The best choice depends on your unique financial situation, goals, and comfort level with risk.

If you’re unsure which path is right for you, seeking professional guidance can help you gain clarity. As a financial advisor specializing in helping women navigate retirement, I can help you develop a strategy that brings you confidence and peace of mind.

Do you need help determining your best path forward? Schedule a free consultation with our team at Pleasant Wealth.

Clinton Miller, CFP®, is an investment advisor & financial planner with an educational background in mathematics. He enjoys making tax planning relevant for clients so they can make confident money decisions.

He and his wife Aubrey are based in Canton, OH & have two sons. In his spare time, he enjoys fishing, chainsaw repair, & mucking around in the woods.